A sub-7% mortgage rate brings holiday cheer

Housing Wire

DECEMBER 14, 2023

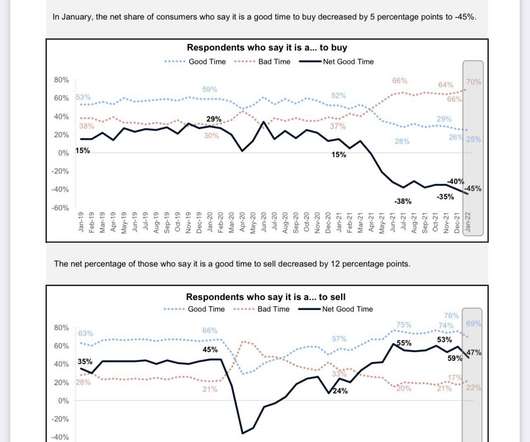

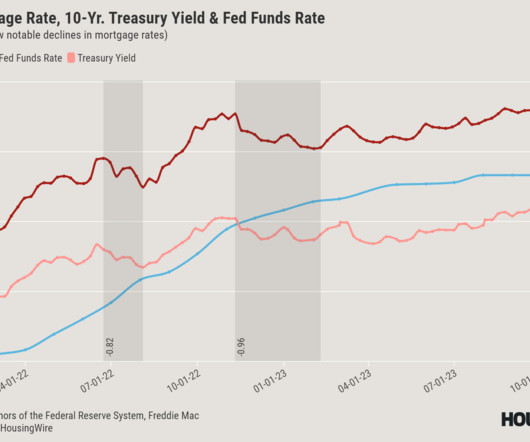

The holidays have come early for the mortgage industry. Mortgage rates fell below the 7% threshold this week as markets prepared for Federal Reserve Chairman Jerome Powell’s announcement on Wednesday. The 30-year, fixed mortgage rate averaged 6.95% for the week ending Dec. on Thursday.

Let's personalize your content