Market Value or Other Value?

George Dell

MARCH 15, 2023

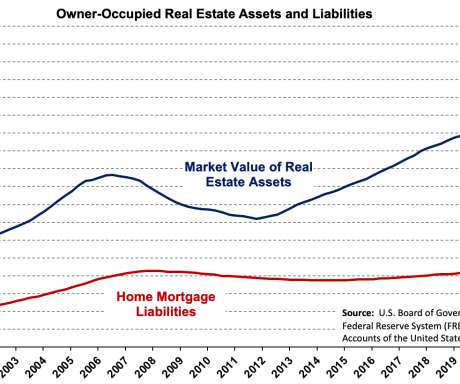

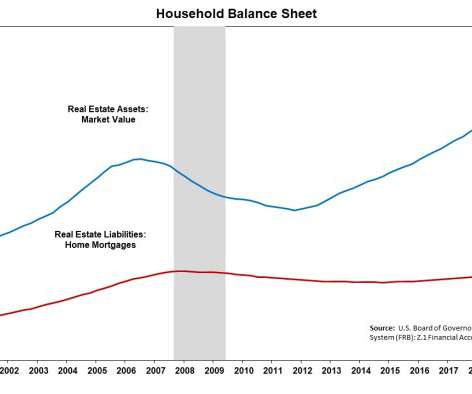

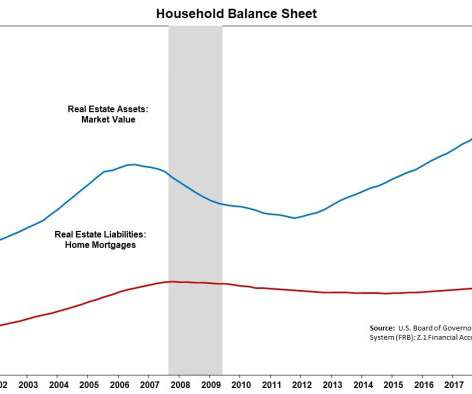

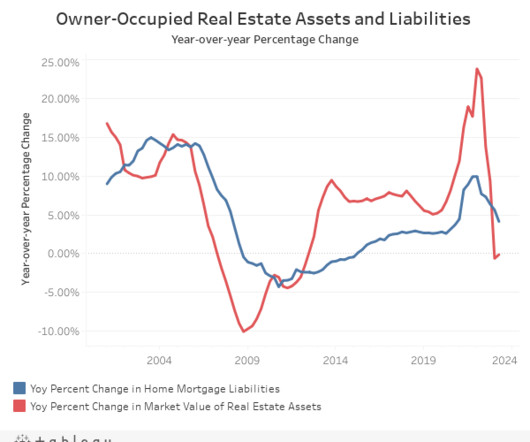

Market value, of course! The great recession, and things like that, which come around every 12-15 years, all concur with the ‘accepted’ definition of market value, as written in the USPAP book Advisory Opinion 30. appeared first on George Dell, SRA, MAI, ASA, CRE.

Let's personalize your content