How this week’s Fed meeting could impact inventory

Housing Wire

MARCH 18, 2024

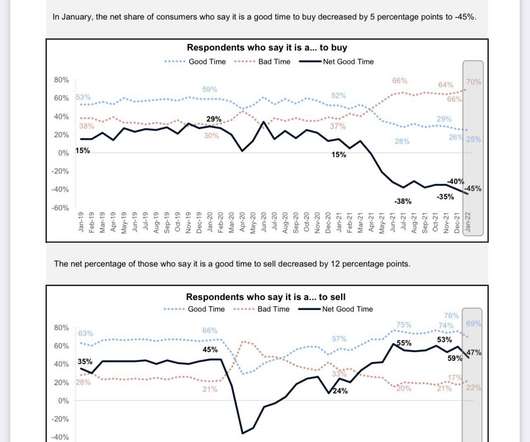

real estate market were for inventory growth, sales growth and home-price growth across the U.S. At the time, I observed that even if mortgage rates stayed flat, the momentum seemed to be in the cards for broad, slow growth in the market. However, mortgage rates didn’t stay flat. If mortgage rates continue to rise to 7.5%

Let's personalize your content