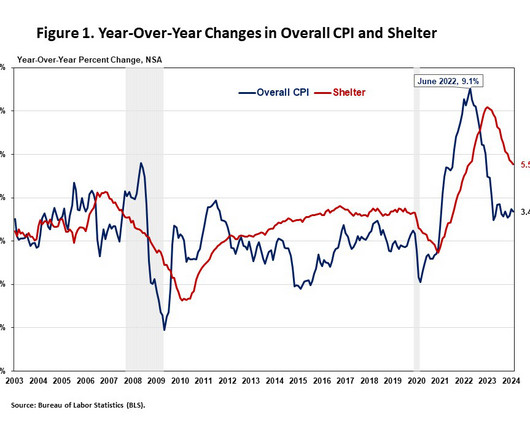

Inflation eases for the first time in three months

Housing Wire

MAY 15, 2024

The most anticipated economic report of the month showed that inflation cooled down a little in April, bringing relief to investors and housing industry professionals. Consumer prices in April were up 3.4% from a year earlier, down from 3.5% in March , according to data released by the Bureau of Labor Statistics on Wednesday. The reading, which came on the heels of the past three stronger-than-expected CPI releases, aligned with economists’ forecasts.

Let's personalize your content