Trade groups want these reforms to reduce property tax foreclosures

Housing Wire

MAY 22, 2024

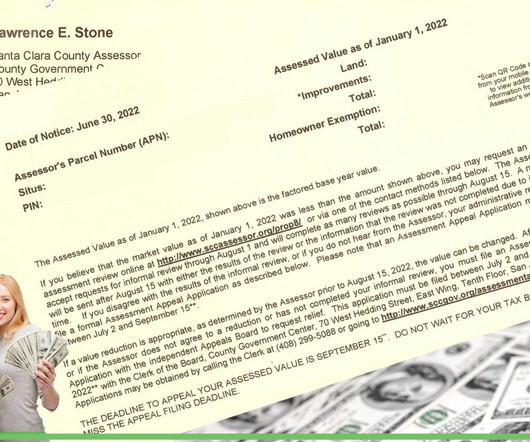

Unpaid property tax debts are leading to preventable foreclosures , with the greatest impacts on Black and Latino households and older homeowners living on fixed incomes. But if states take proactive measures to reform policies and disclosures around tax foreclosures, this could go a long way to prevent unnecessary home displacements.

Let's personalize your content