Pending Home Sales Increased in March But Meaningful Gains Won’t Occur Until Rates Fall

Appraisal Buzz

APRIL 25, 2024

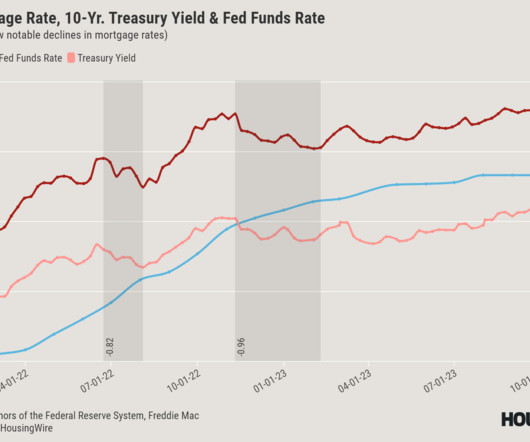

“Meaningful gains will only occur with declining mortgage rates and rising inventory,” Yun says. million in 2025. Inventory will grow steadily from more home construction, and various life-changing events will require people to trade up, trade down or move to another location.” in 2025 to $403,800. to $440,500 in 2025.

Let's personalize your content