2024 inventory growth challenges mortgage rate lockdown

Housing Wire

MAY 25, 2024

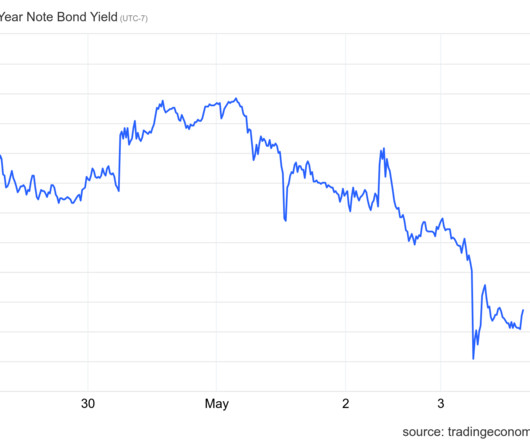

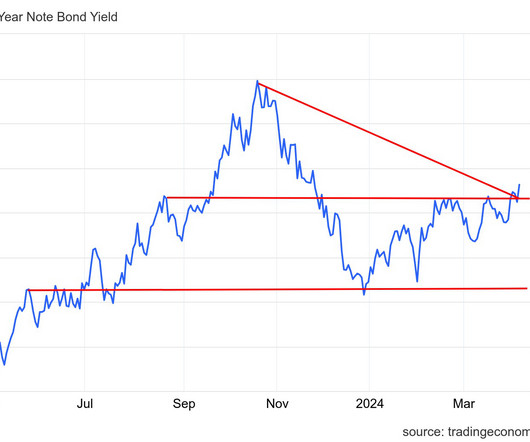

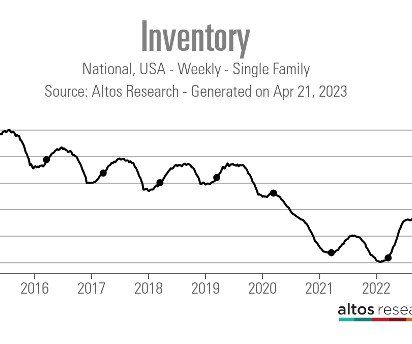

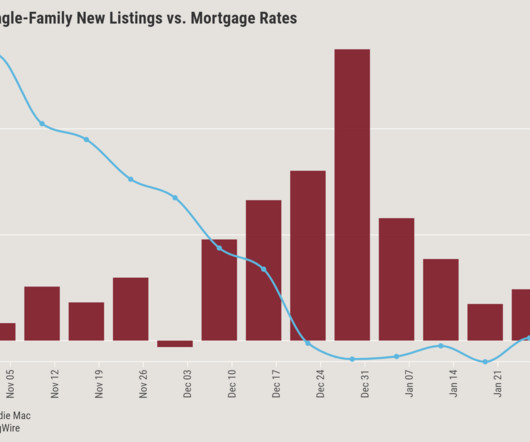

The mortgage rate lockdown premise holds that very few people will list their homes when mortgage rates are this high, thus suppressing inventory. 2024 has had healthy inventory growth despite mortgage rates above 7%. Each time, inventory has squared right into the model as long as rates stay elevated.

Let's personalize your content