Will the housing market continue its hot streak in 2022?

Housing Wire

DECEMBER 10, 2021

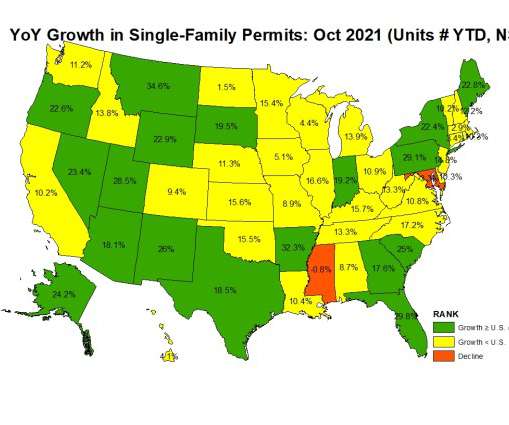

As we approach the end of another hot year for the market, homebuyers and sellers are eagerly looking ahead to the 2022 housing market. Will the market continue its streak of strong growth, or are we finally about to see a slow down? Here’s a high-level forecast for what to expect next year, based on the supply and demand signals we can already see in today’s data.

Let's personalize your content