Consumer protection is what title insurance is all about

Housing Wire

JANUARY 24, 2024

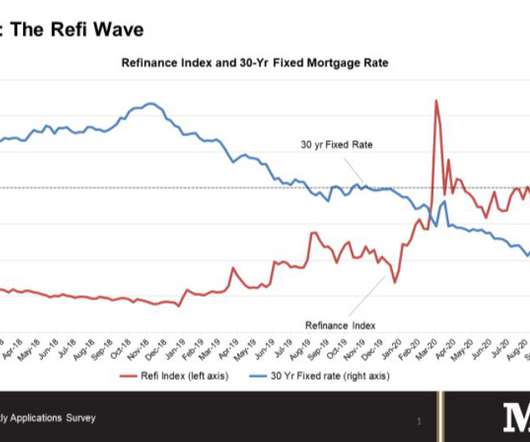

Lower interest rates will not only improve the market for buyers, but it will also encourage more refinancing, particularly for recent homebuyers who stretched their budgets on higher rate loans. Consumers are encouraged to shop around for title insurance and can find a title company to work with in their market at homeclosing101.org.

Let's personalize your content