Is the spring housing market ready for the Fed’s déjà vu?

Housing Wire

MARCH 16, 2024

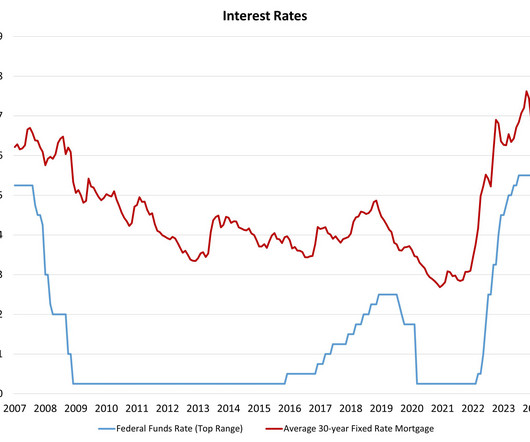

It’s spring 2024 and we have a Federal Reserve meeting this week. The 10-year yield is at the same critical point as last year before the Fed went hawkish and sent mortgage rates to 8% and the 10-year yield to 5%. Could this happen again? This is the week the balls are all in the Federal Reserve ’s court. I believe it is in the Fed’s interest to keep existing home sales depressed.

Let's personalize your content