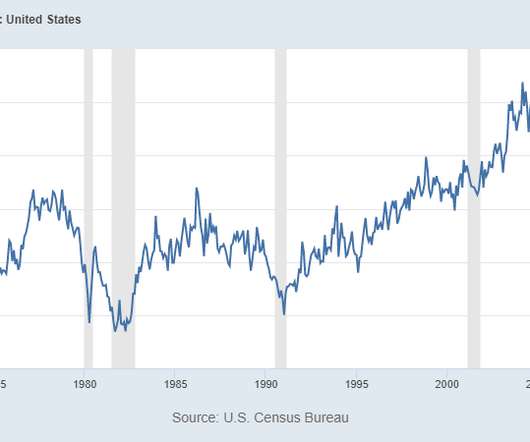

The last time houses were this unaffordable was 2006

Housing Wire

MAY 2, 2022

housing was the least affordable ever back in July 2006 when it took 34.1% Potential borrowers who’ve been priced out of the housing market need to be able to compete with an increasingly growing share of cash buyers and investors who are beating them in bidding wars. percentage points of the prior record,” Graboske added.

Let's personalize your content