The last time houses were this unaffordable was 2006

Housing Wire

MAY 2, 2022

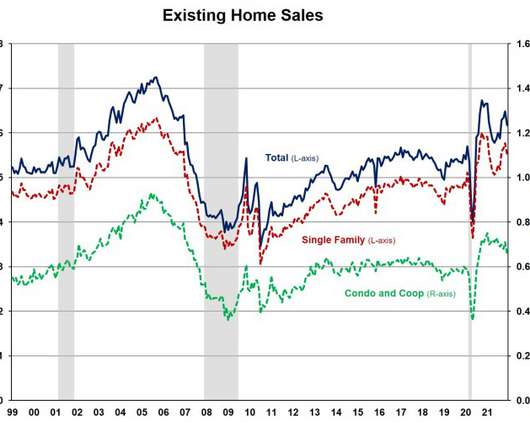

housing was the least affordable ever back in July 2006 when it took 34.1% The post The last time houses were this unaffordable was 2006 appeared first on HousingWire. “As measured by the share of median income required to make the principal and interest payment on the average-priced home bought with 20% down, U.S.

Let's personalize your content