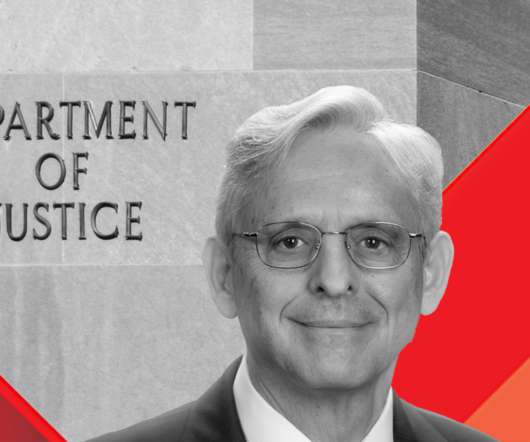

DOJ, OCC, CFPB pledge to combat “modern-day redlining”

Housing Wire

OCTOBER 22, 2021

. “Much has changed since the federal government engaged in Depression-era redlining, but discriminatory lending practices by financial institutions still exist,” Garland said. The post DOJ, OCC, CFPB pledge to combat “modern-day redlining” appeared first on HousingWire. Become a member today. Already a member?

Let's personalize your content