Banks report tighter lending standards for mortgages, HELOCs in Q3

Housing Wire

NOVEMBER 7, 2023

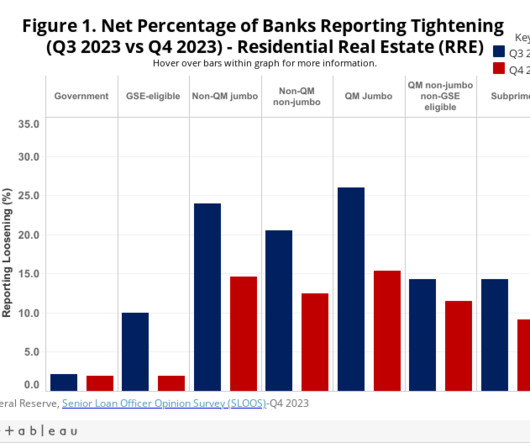

Banks have tightened lending standards for most categories of residential real estate (RRE) loans and home equity lines of credit (HELOC) over the third quarter of 2023. Government residential mortgage was an exception, where standards remained basically unchanged. Responses were received from 62 domestic banks and 19 U.S.

Let's personalize your content