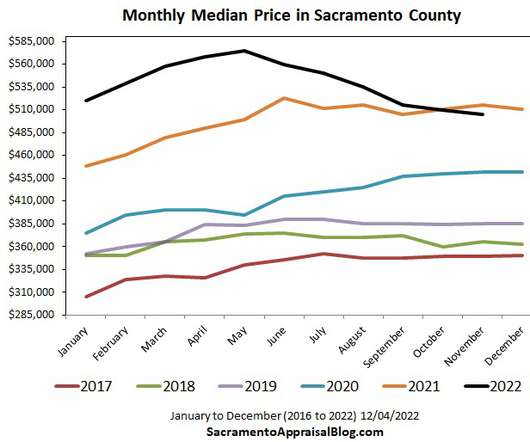

Getting high on housing hope

Sacramento Appraisal Blog

DECEMBER 6, 2022

Be an optimist in life. Be full of hope. And let nothing shake you. But when it comes to housing stats, be realistic about the market that actually exists. Today, let’s talk about getting high on housing hope (and unpack fresh stats). UPCOMING (PUBLIC) SPEAKING GIGS: 1/18/23 WCR Market Update in Cameron Park (register here) […]. The post Getting high on housing hope first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Let's personalize your content