Rising spring prices and appraisers checking the “declining” box

Sacramento Appraisal Blog

APRIL 19, 2023

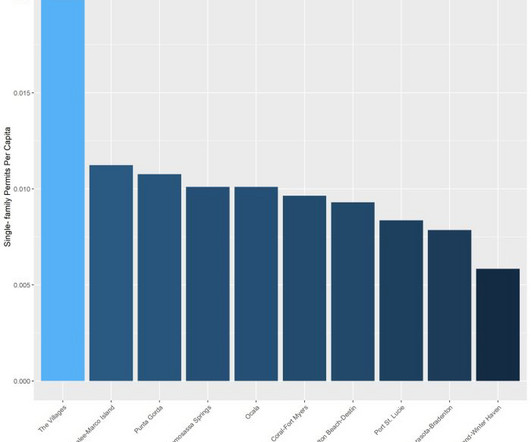

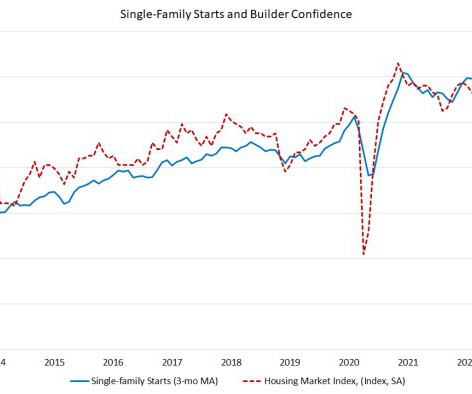

The housing market has really started to heat up lately, and today I want to talk about how I’m thinking about prices right now. I also have some thoughts about checking the “declining” box. Scroll by topic or digest slowly. UPCOMING (PUBLIC) SPEAKING GIGS: 5/4/23 Housing Market Q&A 12-2pm 5/10/23 Empire Home Loans event TBA 5/18/23 SAFE […] The post Rising spring prices and appraisers checking the “declining” box first appeared on Sacramento Appraisal Blog | Real Est

Let's personalize your content