Is inflation or recession driving mortgage rates now?

Housing Wire

MARCH 14, 2023

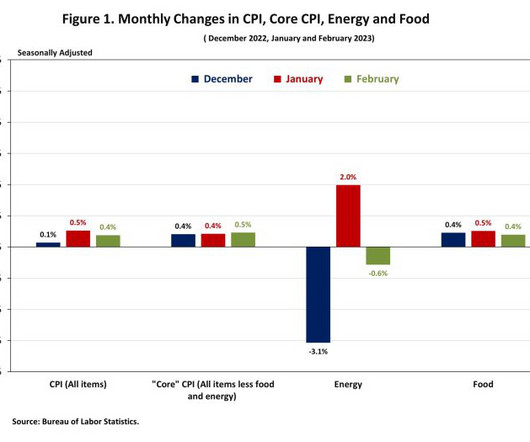

On Tuesday, we got more confirmation that the Federal Reserve ‘s biggest fear — inflation blowing up to 1970s levels — isn’t happening, according to the CPI data. Even with its most significant component, shelter inflation, keeping core CPI higher than it should be, it’s been hard to accelerate the core data. However, with the current banking stress news and the emergency action taken by the Fed to secure the banking sector, the question now is what will drive mortgage rates : infla

Let's personalize your content