Pending home sales slowed considerably in April: NAR

Housing Wire

MAY 30, 2024

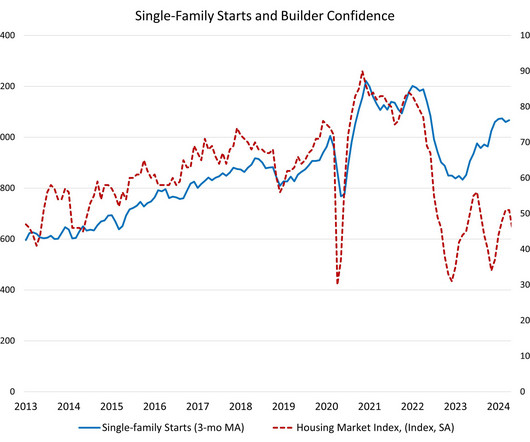

Pending home sales sales dropped 7.7% in April compared to March as rising mortgage rates weighed on the market, according to data released Thursday by the National Association of Realtors (NAR). Year over year, pending transactions fell 7.4%. The NAR’s Pending Home Sales Index declined to 72.3 in April, down from 78.2 in March. All four U.S. regions reported decreases on both a monthly and yearly basis, with the Midwest and West experiencing the largest monthly declines.

Let's personalize your content