In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

Guild Mortgage is expanding its national network of retail branches by nearly 25 percent with the acquisition of Colorado-based Cherry Creek Mortgage, which operates 68 branch offices in 45 states.

Jeff May

Cherry Creek will become a division of Guild, led by co-founder Jeff May, who called the deal “a very strategic offensive move” in an announcement Monday. Terms of the deal were not disclosed.

In addition to conventional, jumbo and FHA loans, Cherry Creek offers federally insured reverse mortgages, jumbo reverse loans and reverse purchase loans— providing an opportunity to expand Guild’s range of services.

It’s the third acquisition in as many months for San Diego-based Guild, which remained profitable last year on the strength of its mortgage servicing business but also shed about 1,100 employees as loan originations plunged 48 percent.

Mary Ann McGarry

“We continue to look for potential new partners with strong local teams, a history of growth and community commitments,” said Guild CEO Mary Ann McGarry in a statement.

Guild operated 270 retail branches at the end of 2022, with licenses in 49 states and Washington, D.C., according to its annual report to investors.

The company picked up 13 additional branches in four Southwestern states in February with the acquisition of Albuquerque, New Mexico-based Legacy Mortgage.

Terms of that acquisition were not disclosed, but McGarry characterized it as “part of the company’s continued plan to grow both in existing markets and by entering new ones with selective acquisitions of like-minded lenders.”

As part of Guild’s Southwest region, Albuquerque-based Legacy Mortgage’s team can offer borrowers a broader range of purchase and refinance loan options — including FHA, VA, USDA, down payment assistance programs and other specialized loan programs — co-owner and CEO Jack Thompson said at the time.

Jack Thompson

Clients “will also benefit from access to new digital and customer relationship tools that improve every step in the lending experience, including servicing, a Guild strength for decades,” said Thompson, who is now Guild’s New Mexico state manager.

Guild kicked off its recent acquisition streak in December, swooping in to buy the assets of a distressed lender, Wisconsin-based Inlanta Mortgage Inc., which operated in 27 states.

In a Nov. 29 letter to the Wisconsin Department of Workforce Development, Inlanta Mortgage President Paul Buege said the company expected to lay off 62 employees in the process of selling its assets to a third-party purchaser, “Due to the dramatic and unanticipated drop in mortgage product demand.”

Inlanta operated out of 59 branch locations over the years, although it’s unclear how many were active when the company was acquired by Guild, according to the Nationwide Mortgage Licensing System and Registry.

While terms of the Inlanta deal were not initially disclosed, Guild revealed in its annual report to investors that the deal closed on Dec. 12 and that it paid $4 million for the troubled lender, including $3.5 million in cash and a contingent consideration of $500,000.

After going public in 2020, Guild expanded its presence in the Northeast by acquiring South Portland, Maine-based Residential Mortgage Services Holdings Inc. (RMS).

The 2021 acquisition of RMS, which employed 250 loan officers working out of 70 retail branches at the time, made Guild a top 10 non-bank retail lender. While the sales price was initially pegged at $196.7 million, Guild has since disclosed in its annual report that the total consideration for the RMS acquisition was approximately $265 million.

Guild mortgage originations, 2007-2022

Source: Guild 2022 annual report to investors

RMS was Guild’s seventh acquisition since 2008, and those deals coupled with low mortgage rates helped it originate a record $36.9 billion in loans in 2021. Although originations plummeted by 48 percent last year as mortgage rates climbed, Guild managed to turn a $328 million profit last year, despite racking up a $15 million fourth-quarter net loss.

By the end of the year, Guild had cut $100 million in annual expenses, primarily through headcount reductions. As of Dec. 31, Guild employed 4,000 U.S. workers, down 22 percent from a 2021 peak of 5,100 workers and a 9 percent reduction from year-end 2020 levels when the company had 4,400 employees.

Guild fared better than some of its competitors who were more dependent on refinancing existing borrowers.

“We demonstrated our proven ability to effectively navigate through a more challenging industry market and interest rate environment,” McGarry said in a fourth-quarter earnings announcement. “This resilience was a direct result of our strategy, as more than 80 percent of our originated loans were purchase mortgages in 2022, including targeting first-time buyers and diverse markets.”

In addition to its retail branches, Guild originates loans through a correspondent channel that purchases closed loans primarily from small community banks and credit unions. Last year, the correspondent channel accounted for 4 percent of originations, up from 2.9 percent in 2021.

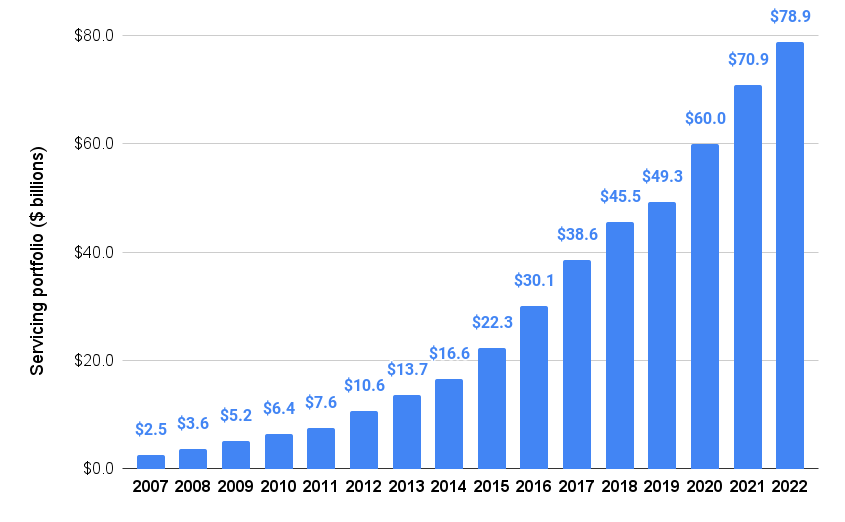

Growth in Guild Mortgage servicing portfolio

Source: Guild 2022 annual report to investors

Guild has also built up its mortgage servicing business, collecting payments from more than 320,000 homeowners on $78.9 billion in loans on behalf of investors. Guild, which generally retains the servicing rights on the loans it originates when it sells them to investors, earned $223.4 million in loan servicing-related fees last year, up 15 percent from 2021.

Loan servicing also gives Guild a leg up when those borrowers are ready to refinance or buy another home.

The company has developed a customized sales platform, Guild360, that provides predictive lead analytics capabilities, marketing automation and lead and loan activity tracking for portfolio and servicing retention campaigns.

“Our technology is differentiated in that we have a proprietary integrated platform for servicing and production,” the company said in its most recent annual report to investors. “As a result, we control our lending process from start to finish and have created a personalized client experience from the time a loan officer takes an application through a loan’s closing, and until the loan pays off and we have an opportunity to recapture the client’s next transaction.”

Last year, Guild was able to “recapture” 34 percent of customers seeking new purchase loans and 43 percent of those looking to refinance — a 39 percent overall recapture rate.

The value of the company’s mortgage servicing rights portfolio increases when rates go up, because borrowers are less likely to refinance with another lender. With rates headed up in 2022, Guild’s net income included a $217.6 million gain in the fair value of its mortgage servicing rights. Low rates in 2021 helped lenders refinance record numbers of loans, and writedowns of the value of Guild’s mortgage servicing rights dented 2021 earnings by $101.6 million.

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.