First-time buyers need to earn $64,500 to afford a typical starter home

Housing Wire

JULY 28, 2023

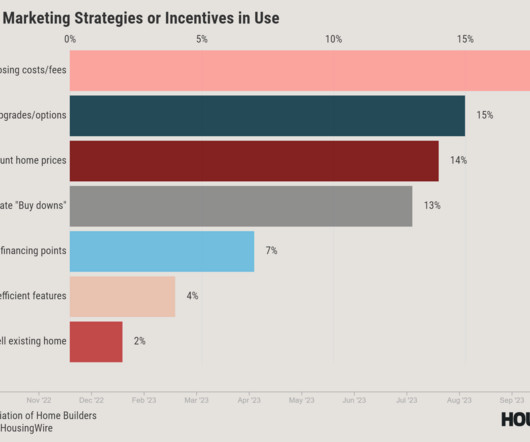

As a result of the limited supply, still-rising prices and elevated mortgage rates, sales activity for starter homes has stifled. The cost of financing a median-priced U.S. home , assuming a 20% downpayment, rose 12.4% Austin buyers must earn $92,000, down 3.3% Austin buyers must earn $92,000, down 3.3%

Let's personalize your content