Transform your real estate career overnight in 8 easy steps

Housing Wire

JUNE 5, 2024

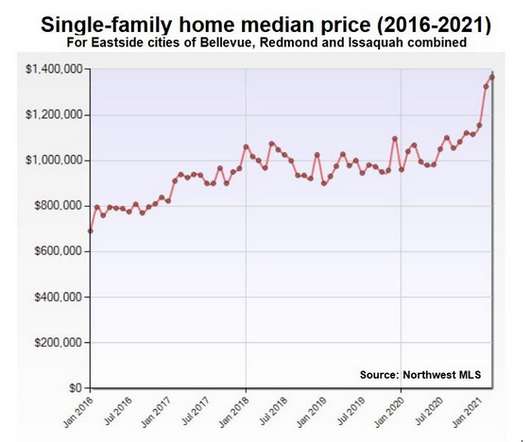

Is there new construction in your market? One for first-time buyers, one for standard move-up and move-down buyers, one for higher-end executive types, and one with portfolio loans for the self-employed. Tour new construction models and get a feel for pricing on each product for each builder. What price ranges?

Let's personalize your content