You survived 2008, you can conquer 2024: Navigating a changing real estate landscape

Housing Wire

JULY 24, 2024

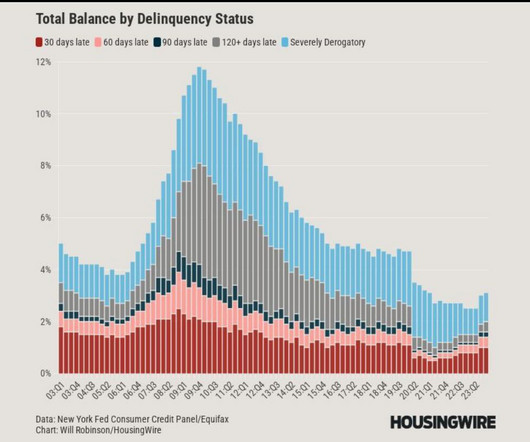

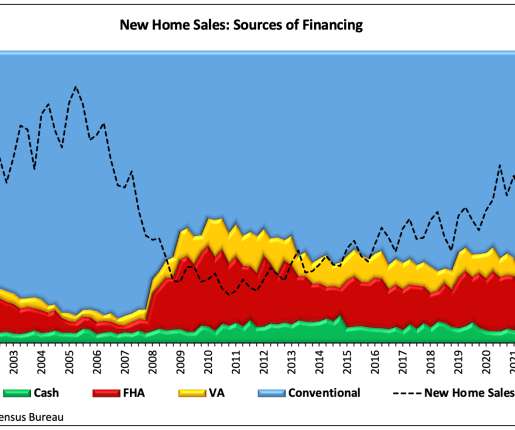

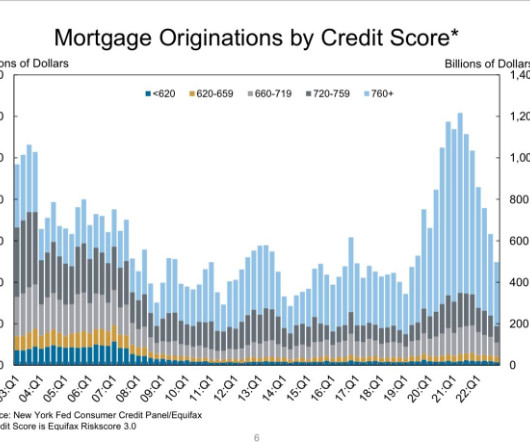

The lofty home prices we’ve seen in recent months have some comparing aspects of today with those foreshadowing the housing bubble that preceded the 2008 market crash and, ultimately, what has come to be known as the Great Recession. The aftermath of the 2008 crisis led to significant attrition among real estate agents.

Let's personalize your content