Why purchase application data is below 2008 levels

Housing Wire

NOVEMBER 9, 2022

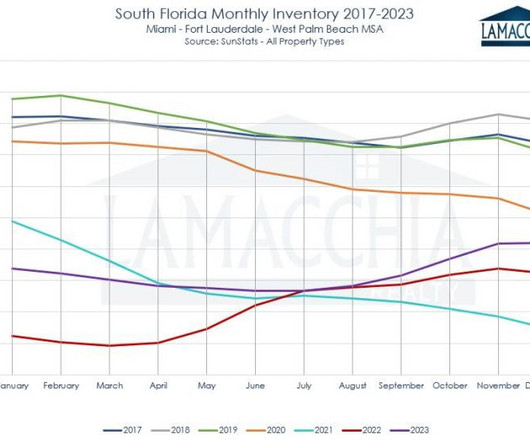

Purchase application data is now below 2008 levels! But I need to explain why this level has more in common with 2014 housing data than the credit stress markets of 2005-2008, and why you should care. New listing data is down 5% year to date, as you can imagine. Right on cue, 2020 came and we hit the 300 level.

Let's personalize your content