Housing credit data in Q4 looks nothing like 2008

Housing Wire

FEBRUARY 8, 2024

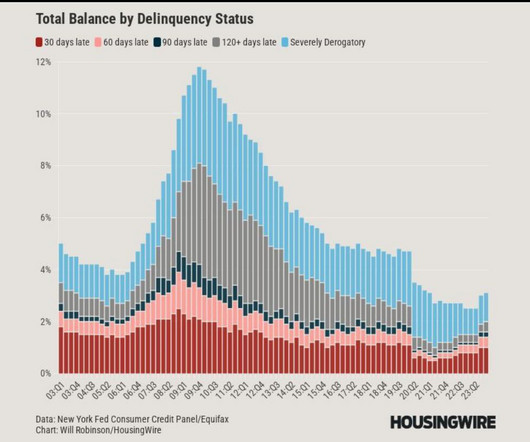

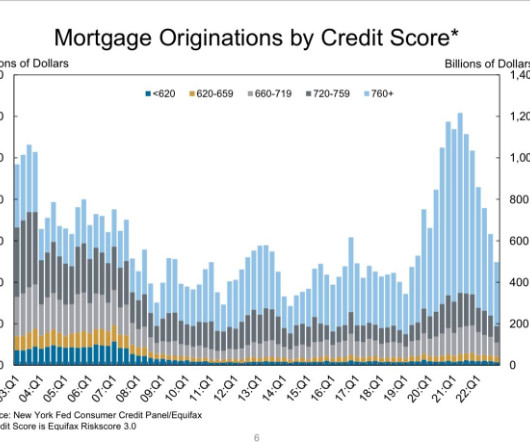

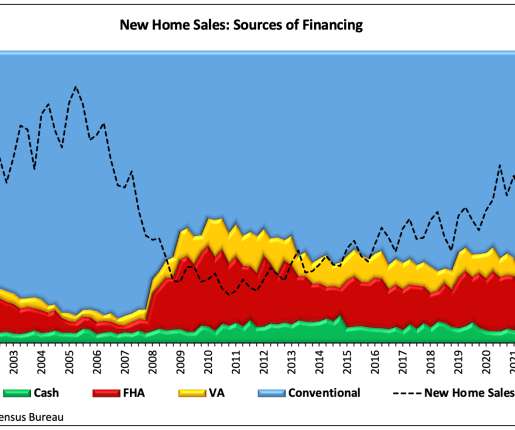

housing credit looks very different than in 2005, 2006, 2007 or 2008. Bankruptcies and foreclosures After 2010, the qualified mortgage laws came into play and all the exotic loan debt structures in the system, especially in the run-up in demand from 2002 to 2005, disappeared. The truth is, U.S.

Let's personalize your content