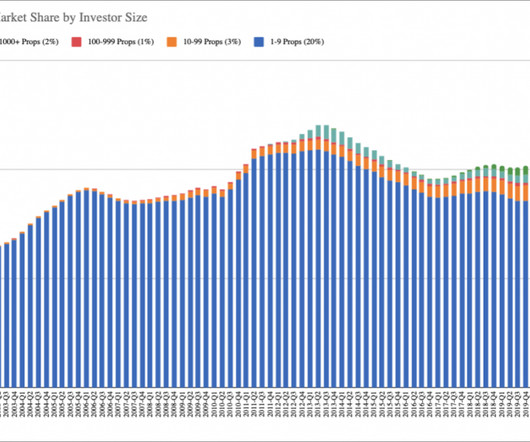

Investor activity slows, still makes up 1 in 4 homes sold in US

Inman

FEBRUARY 28, 2023

New data from John Burns and Redfin shows that investor activity slowed toward the end of 2022 but still accounted for about a quarter of home sales. That's up from about 11 percent in 2001.

Let's personalize your content