Homeowners’ Renovation Spending Doubled Since 2001

Appraisal Buzz

AUGUST 10, 2021

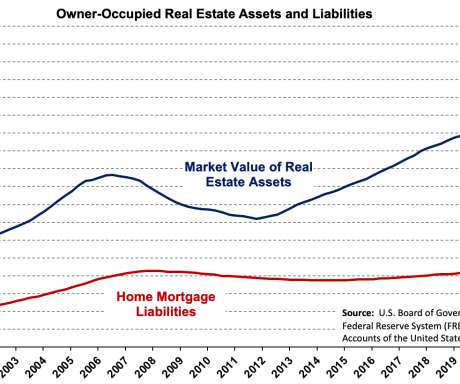

The post Homeowners’ Renovation Spending Doubled Since 2001 appeared first on DSNews. The post Homeowners’ Renovation Spending Doubled Since 2001 appeared first on Appraisal Buzz. The remodeling industry has responded with shifts in scale and specialization, according to a study by Harvard’s JCHS.

Let's personalize your content