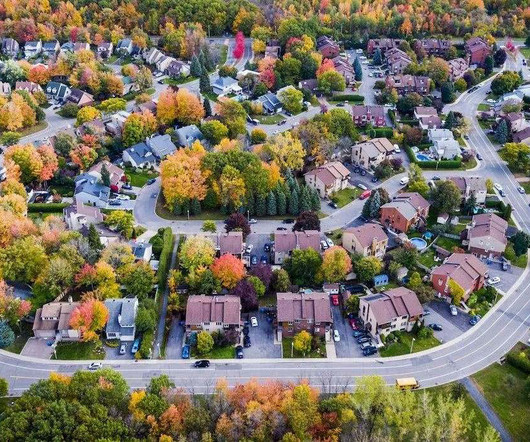

The opportunity cost of modern-day redlining

Housing Wire

APRIL 9, 2024

Modern-day redlining persists, and it’s costing lenders millions in legal fees. trillion in purchase dollars over the next five years, presenting opportunities lenders can’t afford to miss due to antiquated strategies that fail to account for the changing face of America’s homebuyers. More recently, Patriot Bank paid $1.9

Let's personalize your content