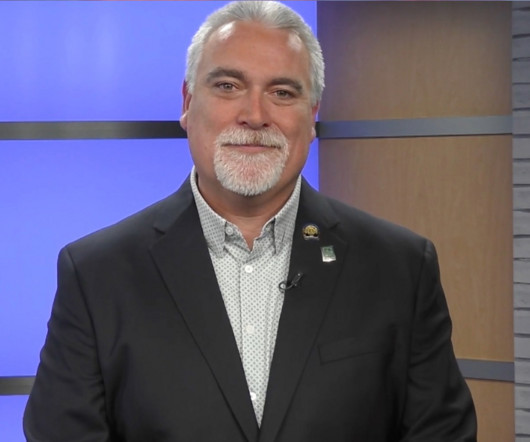

Acra CEO Keith Lind on staying the course amid choppy waters in non-QM

Housing Wire

APRIL 26, 2024

HousingWire sat down with Acra Lending CEO Keith Lind to discuss effective ways to not only survive, but profit in the non-QM space while so many others are closing their doors. We took our rates up simply because that’s what we had to do. But, you know, I’d say the leading factor boils down to being decisive.

Let's personalize your content