Fueling the home-buying process with certainty

Housing Wire

AUGUST 30, 2021

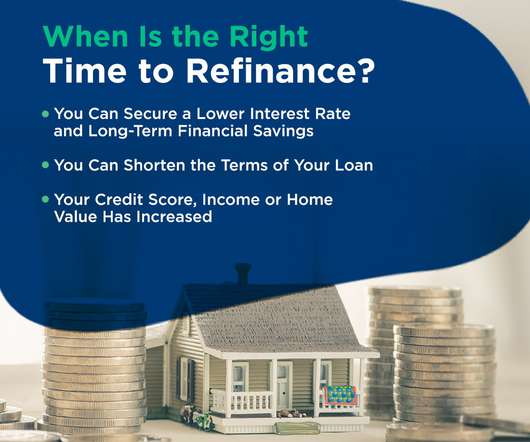

Not to mention chaos as many buyers who purchased after April 2020 experienced COVID-related delays in closings thanks to office closures, supply issues and more. Virtual home tours surged with some buyers putting in offers without physically walking through the property. Refinances also saw a surge.

Let's personalize your content