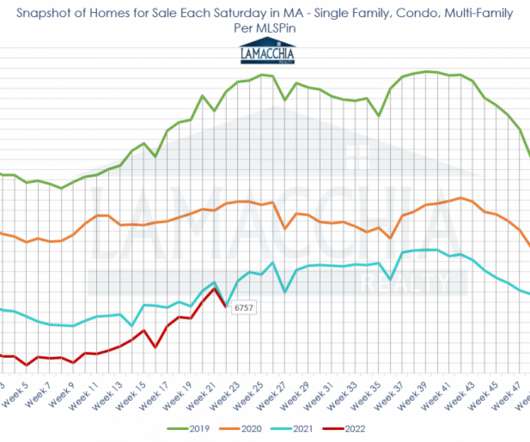

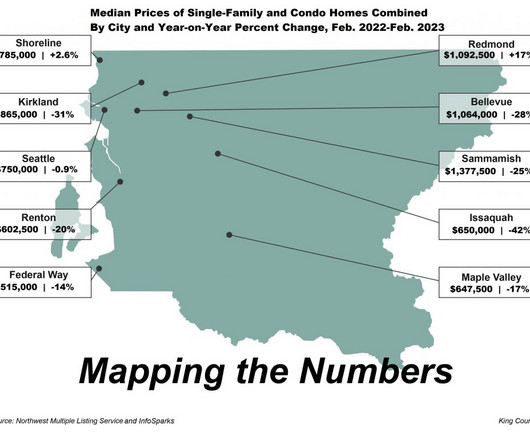

Real estate agents wonder if inventory levels will ever return to ‘normal’

Housing Wire

MARCH 2, 2023

Nationwide, pre-pandemic the first week of February typically marks the lowest point for housing inventory during the year, as sellers return to the market in time for spring, but since the onset of the pandemic this predictable trend has been thrown out the window. “ What happened to ‘normal’?

Let's personalize your content