DataDigest: Where for-sale inventory went and when it’s coming back

Housing Wire

FEBRUARY 7, 2024

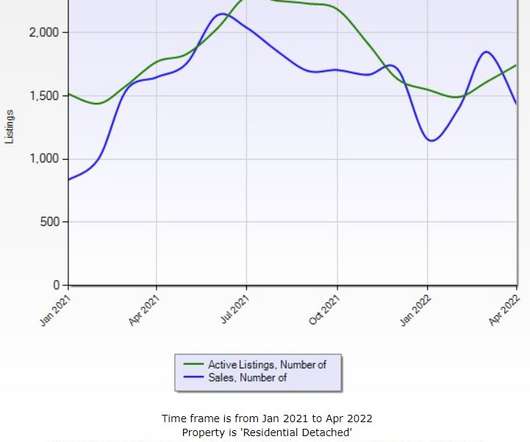

With mortgage rates briefly topping 8% and home prices breaking records throughout the year, many would-be sellers simply decided not to bother listing their homes, exacerbating already tight inventories. This squeezed inventory even further throughout 2022 and 2023, pushing home prices to record highs month after month.

Let's personalize your content