Mortgage rates hit another record low at 2.67%

Housing Wire

DECEMBER 17, 2020

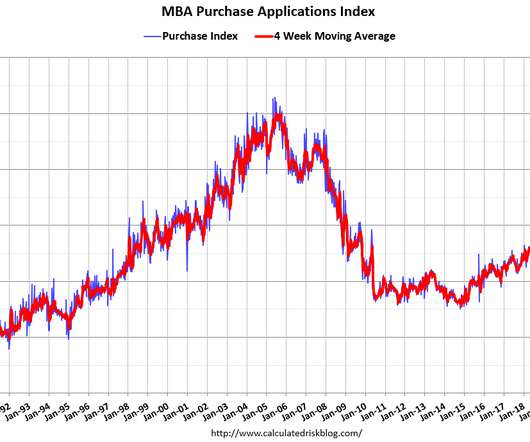

The average U.S. mortgage rate for a 30-year fixed loan fell four basis point this week to 2.67% – the lowest rate in the Freddie Mac ’s Primary Mortgage Market Survey’s near 50-year history. This week’s mortgage rate broke the previous record set on Dec. 3 and is the first time the survey has witnessed it fall below 2.7%. “The housing market continues to surge higher and support an otherwise stagnant economy that has lost momentum in the last couple of months,” said Sam Khater, Fred

Let's personalize your content