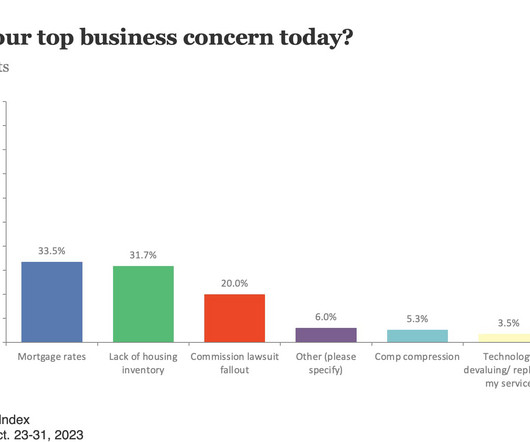

Here’s what you can expect from the 2024 housing market

Housing Wire

NOVEMBER 22, 2023

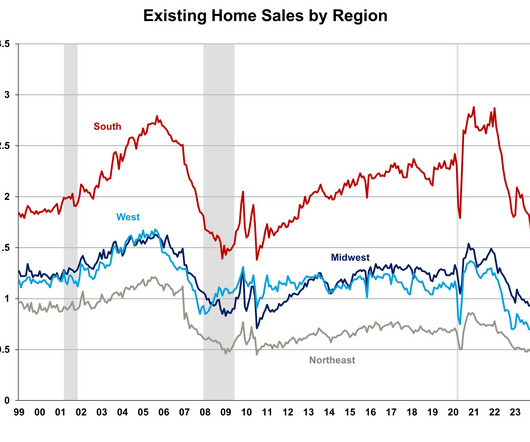

Going more in-depth than a Fed meeting, our virtual Housing Market Update event provides you with the strategy-building insights needed to operate in 2024. It’s a savagely unhealthy housing market out there, and these economists unpack what that means for you. Register for the virtual event on Dec. 11 here. In a typical year, there are about 5.2 million sales of existing homes nationally and home prices rise by about 4%.

Let's personalize your content