Sellers have been sitting out of the housing market too

Sacramento Appraisal Blog

FEBRUARY 7, 2023

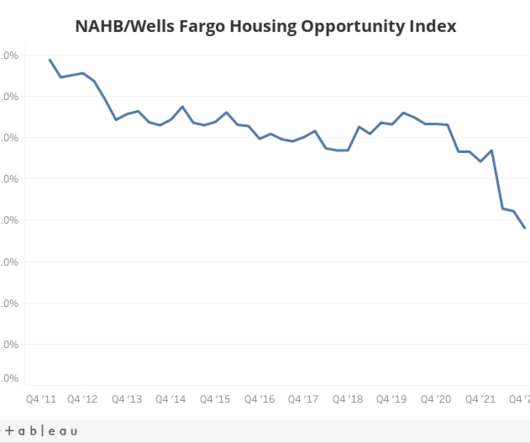

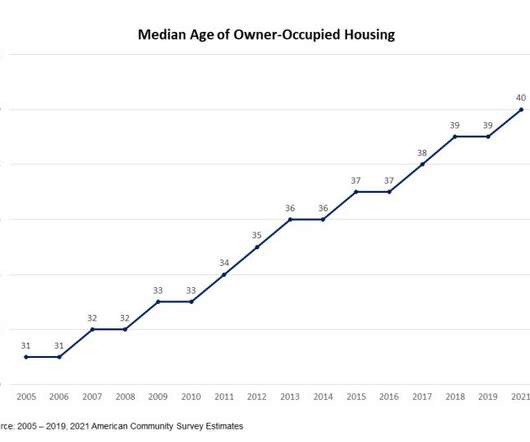

There is so much talk about buyers sitting on the sidelines right now, but let’s talk about sellers who are also sitting. This is a local trend, but it’s something showing up in many markets across the country also. UPCOMING (PUBLIC) SPEAKING GIGS: 2/8/23 SAFE Credit Union “Snacks & Facts” (for RE) (register here) 3/06/23 […] The post Sellers have been sitting out of the housing market too first appeared on Sacramento Appraisal Blog | Real Estate Appraiser.

Let's personalize your content