Will hotter inflation send mortgage rates back over 7%?

Housing Wire

FEBRUARY 14, 2023

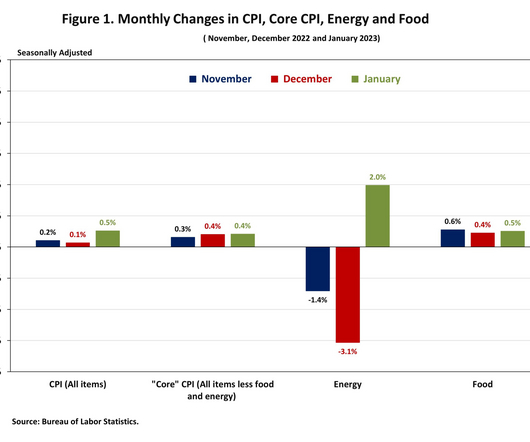

Given the hotter inflation reported in Tuesday’s CPI data , can mortgage rates go above the 2022 peak of 7.37%? Initially the 10-year yield fell after the report, then rose higher, only to fall back down again. For all the hype around today’s stock market close, it was a dud of a Valentine’s date if you ask me. A lot of times, on days when big economic reports are released, you can get wild intraday action but not have much happening by the end of the day.

Let's personalize your content