Revolution Mortgage integrates Tavant’s Touchless Lending

Housing Wire

JANUARY 23, 2023

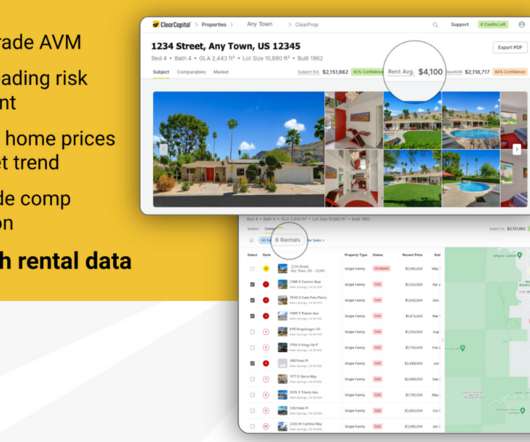

Mortgage lender Revolution Mortgage has partnered with Tavant, an AI-powered digital lending company, to integrate Tavant’s Touchless Lending product suite into Revolution Mortgage’s platform. Tavant, an HW Tech100 winner for multiple years, helped underwrite more than 80,000 loans in 2021.

Let's personalize your content