Truity Credit Union Using Dark Matter’s Empower LOS

Appraisal Buzz

MAY 23, 2024

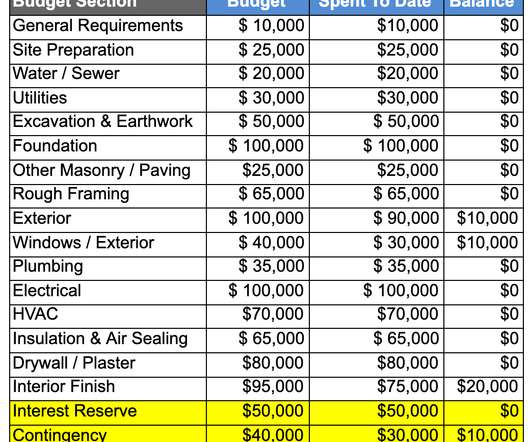

Truity Credit Union , a member-owned credit union with locations in Oklahoma, Kansas and Texas, is using Dark Matter’s Empower loan origination system to provide loan officers and members a modern, mobile-friendly experience across home purchase, refi, home-equity and construction loan originations.

Let's personalize your content