Wall Street investors are the new breed of single-family landlords

Housing Wire

NOVEMBER 4, 2021

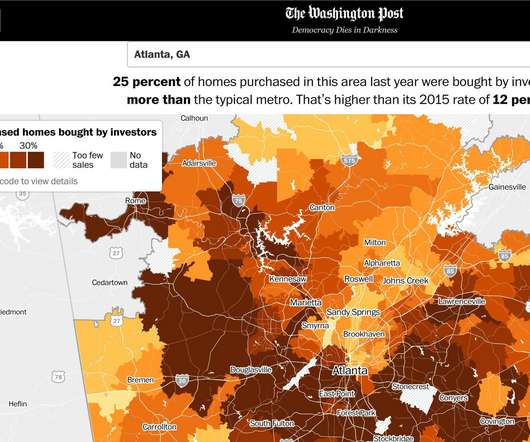

Purchases of single-family rental properties by investors are on the rise in Sunbelt cities like Phoenix; Austin, Texas; Las Vegas; Tampa; and Charlotte, among others, according to research by John Burns Real Estate Consulting. The post Wall Street investors are the new breed of single-family landlords appeared first on HousingWire.

Let's personalize your content