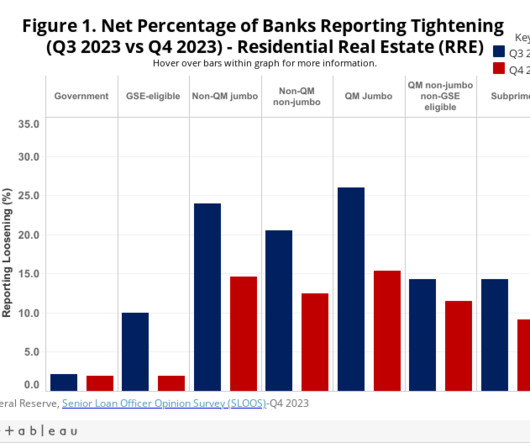

Mortgage rates are the highest they’ve been this year. Did loan officers expect this?

Housing Wire

MARCH 5, 2024

“ Recovery year ” was the theme heading into 2024 as mortgage professionals hoped for some reprieve in a frozen housing market characterized by high interest rates, low inventory levels and sluggish sales. What I tell all loan officers, no matter who I talk to, is that there’s no foreclosure crisis coming on the horizon,” Saghafi said.

Let's personalize your content