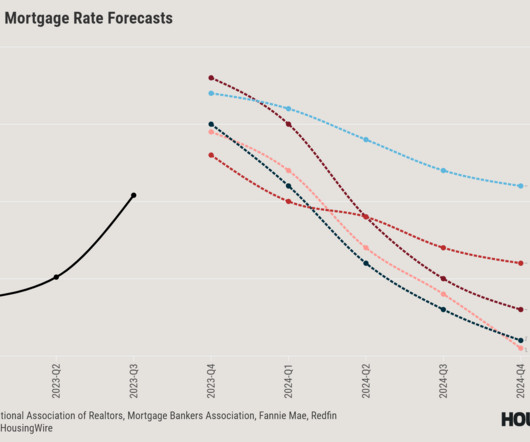

Are these the lowest mortgage rates we’ll see in 2024?

Housing Wire

SEPTEMBER 22, 2024

Have we seen the bottom in mortgage rates for 2024 after a crazy roller coaster ride so far this year? My 2024 forecast had a mortgage rate range of 7.25%-5.75%. With the 10-year yield at 3.74% as of Friday, we have some room left to reach the very bottom of the 2024 forecast before the year is out.

Let's personalize your content