DataDigest: How and where homebuilders are closing deals

Housing Wire

NOVEMBER 22, 2023

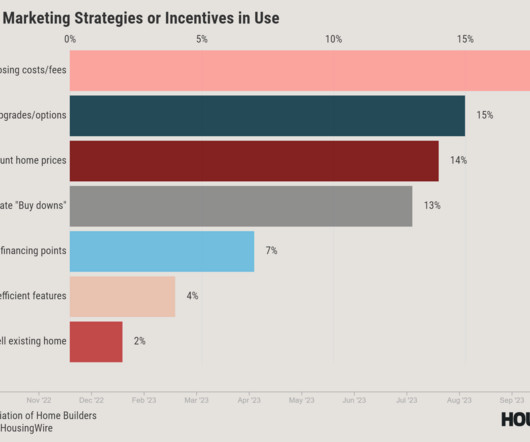

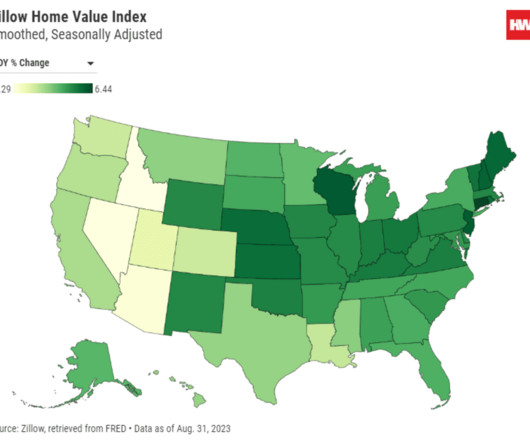

The Western pessimism is also unsurprising given the year-over-year declines Western states have seen in home values. Builders reported covering closing costs, offering discounted or free features, helping buyers sell their existing home and providing other incentives. 2019 level. If the nation’s largest homebuilder, D.R.

Let's personalize your content