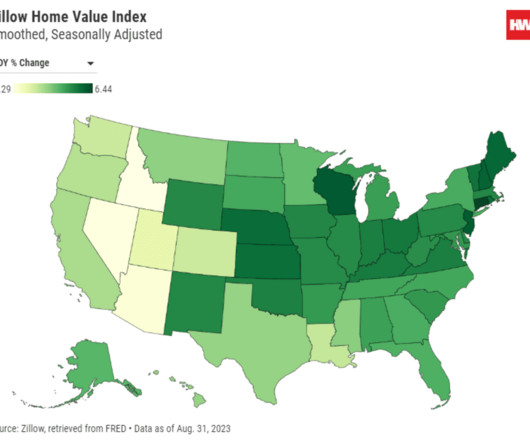

Coastal California metros were the priciest in March: Zillow

Housing Wire

APRIL 15, 2024

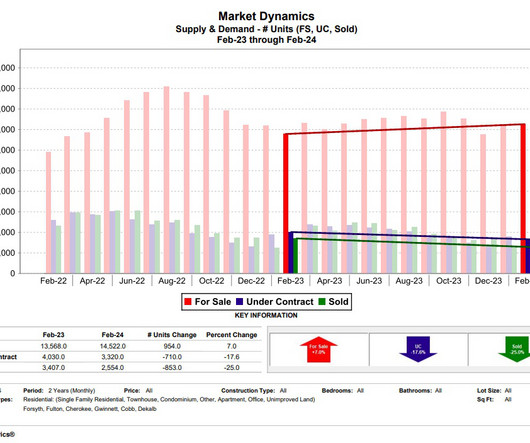

Home prices are surging in major U.S. metros, with coastal California cities and Seattle leading the charge in monthly home value growth, according to Zillow’s newest market report. These metros also continue to grapple with below-average inventory recovery, maintaining pressure on buyers.

Let's personalize your content