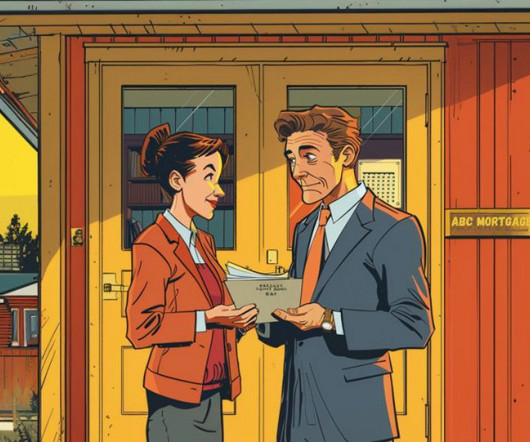

Newrez partners with Newzip to court more homebuyers

Housing Wire

FEBRUARY 28, 2024

Top 10 mortgage lender and servicer Newrez is partnering with Newzip , a tech-enabled real estate platform, to roll out a program aimed to save buyers and sellers on credit costs. Dubbed Newrez Home Rewards, buyers will be matched with a real estate agent who works with Newzip and provided booking services.

Let's personalize your content