Buyers take power from sellers. It’s their turn.

Sacramento Appraisal Blog

JULY 18, 2022

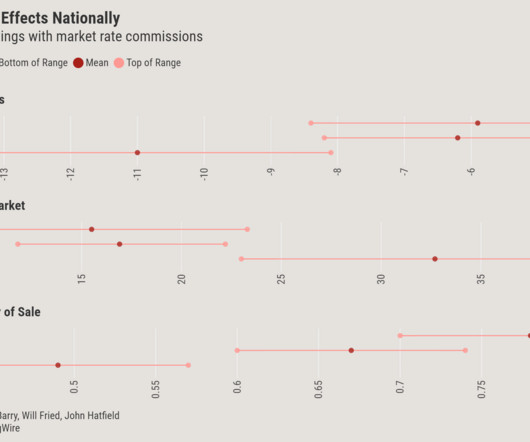

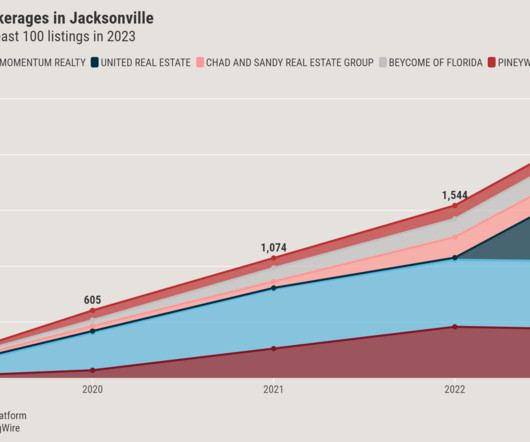

Buyers are gaining power. And sellers are losing it. UPCOMING (PUBLIC) SPEAKING GIGS: 7/20/2022 Beer & Stats at Out of Bounds (sign up (for real estate agents)) 7/26/2022 Navigating […]. I have some new visuals to show what the market is doing right now.

Let's personalize your content