Consumer advocacy group: Buyer agency agreements often contain “unfair” terms

Housing Wire

FEBRUARY 28, 2024

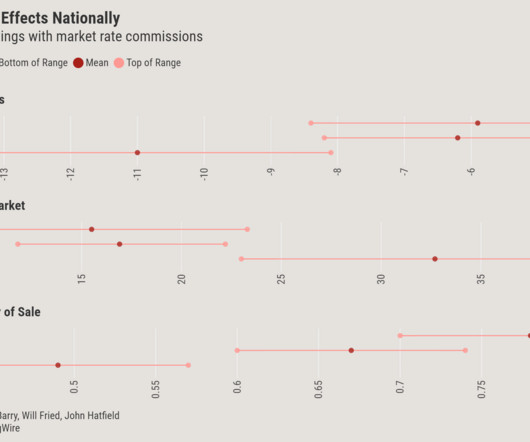

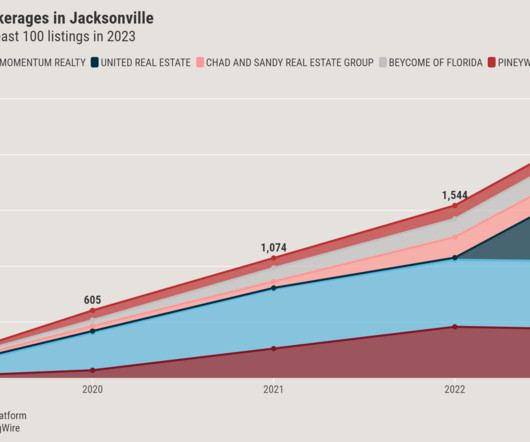

As brokerages across the country have begun implementing buyer agency contracts into their business practices in the wake of the Sitzer/Burnett commission lawsuit verdict, the Consumer Federation of America is warning consumers that they may be filled with “unfair provisions” that primarily protect agents and brokers.

Let's personalize your content