Buyers are getting cold feet as mortgage rates exceed 7%: Redfin

Housing Wire

SEPTEMBER 15, 2023

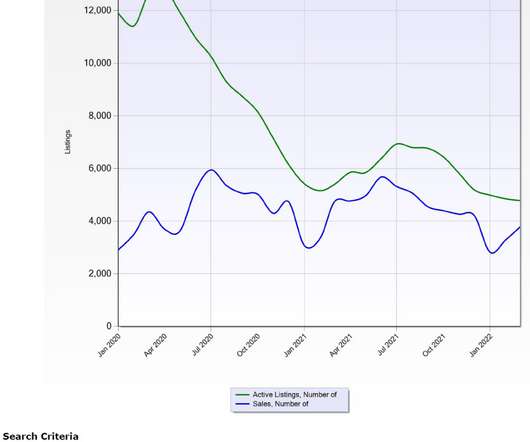

Buyers facing high mortgage rates are pulling out of their home-purchase agreements at the highest rate in nearly a year. of homes that went under contract that month, according to a new report from Redfin. A lot of sellers are also willing to let buyers slip away because they don’t want to concede to repair requests,” Morre said.

Let's personalize your content