Black-owned home values appreciated the most during the pandemic

Housing Wire

FEBRUARY 27, 2023

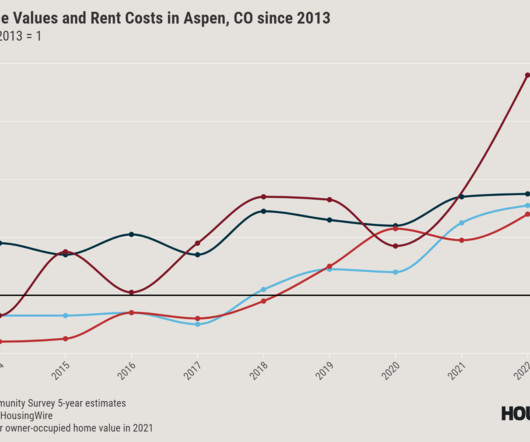

Per the report, Black homeowners saw their home values increase by 42.5% for overall home values and 37.8% for white-owned home values. On the other hand, the values of Hispanic and Asian-owned homes increased by 38.3% home is now the smallest it’s been in more than two decades.

Let's personalize your content