Top markets for affordable renovated housing inventory

Housing Wire

OCTOBER 8, 2021

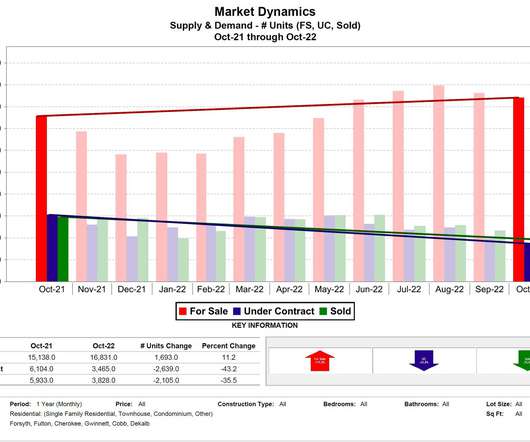

home prices are quickly shifting the affordability calculus for prospective homebuyers in 2021 — even though mortgage rates have remained near record lows. Despite average 30-year mortgage rates that have remained below 3% for most of 2021, the rapid home price increases are eroding affordability for average wage earners.

Let's personalize your content