These housing markets are most likely to correct based on foreclosure buyer behavior

Housing Wire

OCTOBER 20, 2022

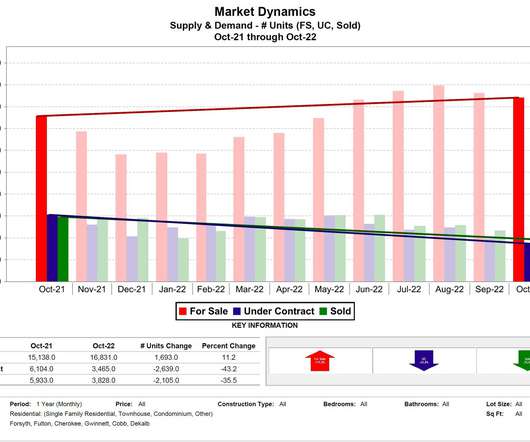

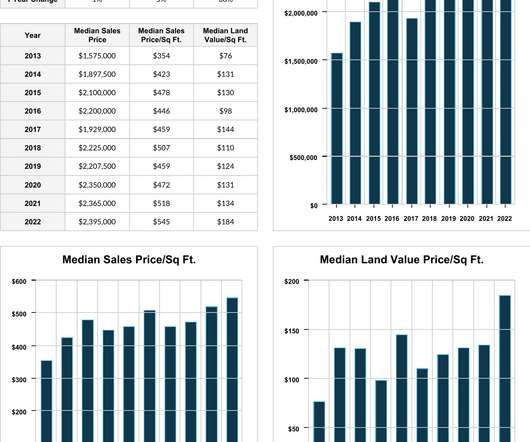

A deeper dive into foreclosure buyer behavior shows which markets are most likely to see a home price correction in the next six months. Foreclosure auction buyers started bidding more conservatively in the second quarter of 2022, as measured by proprietary data from the Auction.com marketplace. Price Correction Risk by Region.

Let's personalize your content