Proposed Design of the URAR

Appraiserblogs

MARCH 17, 2022

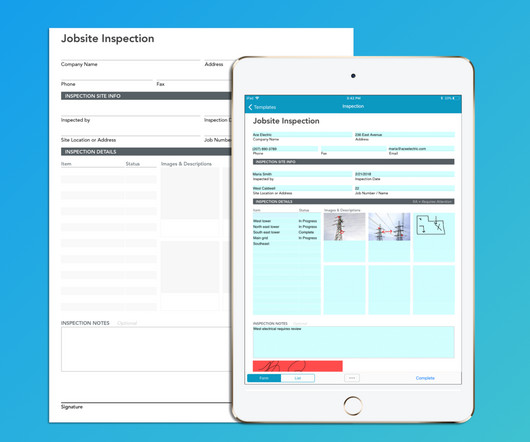

Here’s the link to the ‘slide show’ the GSE’s have produced showing proposed design of the future, revised, URAR appraisal form. Related Posts: Appraisal Forms Redesign In 2018, the GSEs began working on 'mortgage lending appraisal forms redesign', a process they said would take approximately 3….

Let's personalize your content